US Home Sales Hit Unprecedented Low

In a surprising turn of events, US home sales dropped dramatically in May, falling 15% below the average for the month, even as median prices soared to a record $367,000. This continued push upward in pricing has left many potential homebuyers feeling sidelined as they grapple with affordability issues amidst rising interest rates and a volatile market.

What’s Causing the Decline?

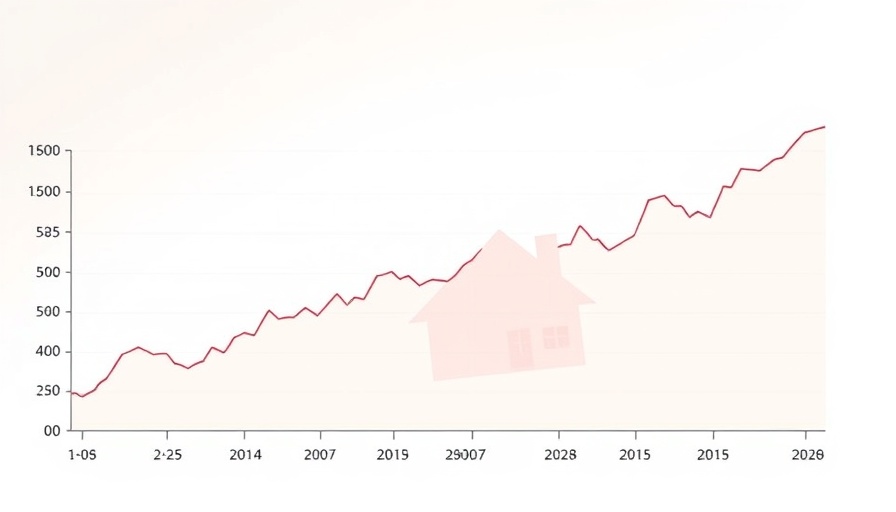

The slump in home sales highlights the ongoing struggle in the real estate market, particularly in areas like Bakersfield, CA, where many residents are witnessing first-hand the challenges associated with homeownership. According to experts, the discrepancy between wages and property values is a major factor contributing to this decline. While homes appreciated at an average rate of 7.4% per year over the past six years, the median growth has nearly stagnated at only 2% in the last year. This creates a significant barrier for first-time homebuyers and those hoping to upgrade their living situation.

Investor Influence and Local Dynamics

Adding to this complexity is the rising number of homes being bought up by investors, particularly in Southern California, where data suggests that 17% of houses are owned by investors. This trend fuels competition for available properties, further driving prices up while limiting options for individual buyers. For locals in Bakersfield, this can be frustrating, as many find themselves competing against investors who may have the capital to outbid traditional buyers. As a result, open listings become scarce, exacerbating affordability challenges.

The Ripple Effects on Communities

The decline in home sales is not just an economic statistic; it embodies real consequences for families and communities. As homes become less attainable, the community faces a growing divide between homeowners and renters. The surge in property prices can lead to increased rental costs, forcing some families to relocate to more affordable regions, which harms local businesses and schools. It’s essential for residents to understand the implications of these changes not just for their housing situations but for the community as a whole.

Future Predictions: Where Do We Go From Here?

Looking ahead, experts warn that if interest rates continue their upward trajectory, we may see even further dips in home sales. Additionally, potential changes in government policy aimed at addressing housing affordability could shift market dynamics. Residents should stay informed about local real estate trends and consider how policy changes—such as incentives for first-time buyers or adjustments in zoning laws—may impact their opportunities to purchase a home in the future.

Decisions Homebuyers Can Make Today

For those contemplating a home purchase in Bakersfield, now might be the time for strategic planning rather than immediate action. Enhancing one's financial readiness—such as improving credit scores, saving for larger down payments, or exploring first-time buyer programs—can make a significant difference in the competitive market. Working with a knowledgeable real estate agent can guide prospective buyers through this challenging environment and help them make informed choices.

Conclusion: The Importance of Staying Informed

In light of the current housing market trends, staying informed is crucial for navigating this challenging landscape. As prices remain high and home sales trend downward, potential buyers must understand the state of the market to make informed decisions. By keeping an eye on local developments, engaging with community resources, and adapting their strategies, residents can equip themselves to weather this evolution in the housing market effectively. Buying a home is a milestone, and being prepared is key to achieving that goal.

Add Row

Add Row  Add

Add

Write A Comment