The Investor Invasion: A Shift in Home Buying Dynamics

The U.S. housing market is witnessing a significant transformation, as real estate investors secure an increasingly dominant share of homes sold across the country. A recent report revealed that investors purchased an astounding 27% of homes in the first quarter of 2025—marking the highest percentage in five years. This surge reflects the growing struggle traditional buyers face amidst soaring home prices and elevated borrowing costs.

Affordability Crisis: Who's Being Left Behind?

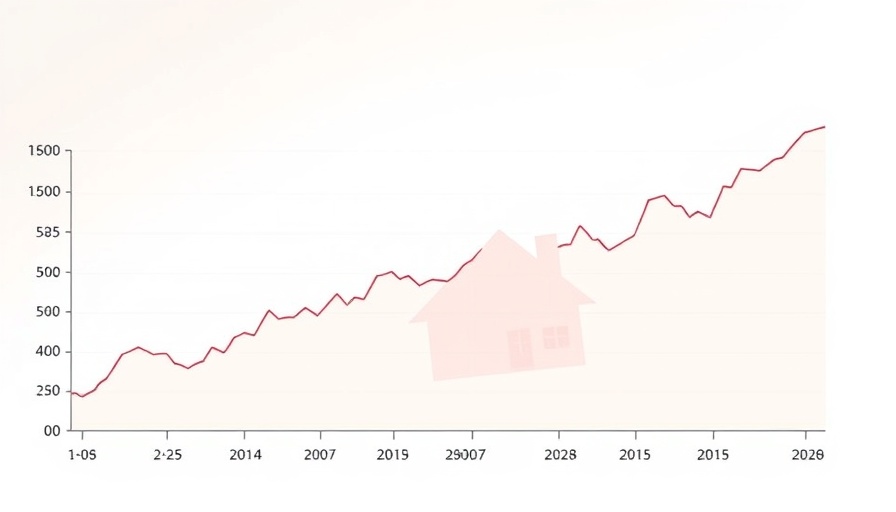

As traditional buyers grapple with escalating housing expenses, investors are stepping in with cash reserves and financing advantages, significantly affecting the market dynamics. According to BatchData, the number of homes bought by investors has consistently increased since 2020, highlighting a stark contrast to the declining ability of first-time and conventional buyers to enter the market.

Rising Inventory and the Appeal for Cash Buyers

The slowdown in home sales, partly attributed to rising mortgage rates since 2022, has led to longer selling times and a larger inventory of homes available for purchase. This environment is particularly favorable for investors who can afford to avoid high mortgage rates by purchasing properties outright or using equity from other investments.

While investors bought 265,000 homes in the first quarter of 2025—an increase from the previous year—this uptick serves primarily as a response to the persistent sales decline affecting traditional buyers. The competitive edge held by investors is evident as they navigate lower buyer demand with cash transactions, which allows them to sidestep the hurdles linked to financing.

Encroaching Investor Influence in Local Markets

This influx of investor purchases has profound implications for the local housing market in areas such as Bakersfield, CA. As homeowners seek affordable options, investor dominance can put upward pressure on prices, locking many potential homeowners out of the market entirely. Bakerfield residents may find themselves increasingly at the mercy of this shift, where homes that might have otherwise been accessible are snapped up by investor entities.

The Role of Institutional Investors and Future Prospects

The report from BatchData also highlights that while mom-and-pop investors dominate the landscape, holding about 85% of investor-owned homes, the activity of institutional investors is starting to retreat. Notably, six out of eight major institutional firms that typically purchase large volumes of homes sold more properties than they acquired in the second quarter of 2025. This trend may suggest an inflection point in the market, where institutional investors reconsider their strategies amid fluctuating profits and increased scrutiny.

Statistical Insights: What the Numbers Reveal

Analyzing the trajectory of investor purchases offers a window into the broader economic climate and housing trends. Between the years 2020 and 2024, the overall market saw investor acquisitions rise from 18.5% to nearly 27%, reflecting a drastic shift in home-buying patterns. This increase underscores how a vast segment of would-be homeowners is struggling against a daunting affordability crisis.

Local Impact: Navigating the New Normal

For residents in Bakersfield, the current real estate landscape poses both challenges and opportunities. As investors concentrate their purchases, the traditional avenue of home acquisition may require reassessment. Solutions may involve innovative strategies such as collaborative purchasing among local homebuyers, community engagement initiatives, and exploring varied financing models to create more accessible pathways to homeownership.

Looking Ahead: What Can Be Done?

Communities must rally to address the market disparities driven by investor activities. Local governments and organizations could play vital roles in crafting programs aimed at easing the homeownership process for residents. Initiatives promoting affordable housing projects or offering financial literacy programs may empower potential buyers, ensuring that they too can compete in this challenging market.

Conclusion: A Call to Action

As the housing market evolves, so must our strategies and solutions to forge pathways to homeownership in our communities. Individuals interested in buying homes should consider collaborating with local organizations to explore collective buying ventures or pursuing educational resources to improve their financial readiness. Together, we can work towards ensuring that the American dream of homeownership remains attainable for everyone, even amidst these turbulent times.

Add Row

Add Row  Add

Add

Write A Comment