Living in a Piece of History: The Allure of Frank Lloyd Wright's Usonian Homes

For many Californians, the homes designed by the legendary architect Frank Lloyd Wright are enchanting reminders of America's architectural heritage. This is particularly true in the Bay Area, where his Usonian homes embody a unique blend of functionality and aesthetic beauty, appealing to those who appreciate living in spaces that tell a story.

Understanding Usonian Architecture: A Glimpse into Wright's Vision

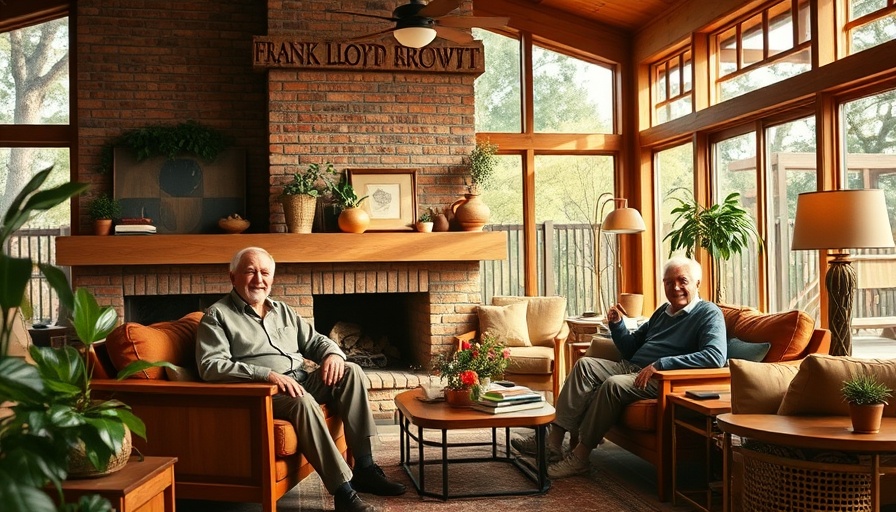

Frank Lloyd Wright coined the term "Usonian" to describe a concept he envisioned as a quintessentially American style of architecture. His aim was to create homes that resonated with the American spirit, offering a reflection of democracy and freedom. Unlike many architectural styles that borrowed heavily from European influences, Usonian homes featured low-slung designs, large windows, and an emphasis on blending seamlessly with their landscapes.

William J. "Bill" Schwarz, a Marin County architect, elaborates on Wright’s vision, stating that these homes were meant to be elegant yet simple—a celebration of openness and natural light. Wright’s intention was not just to construct homes, but rather to foster a harmonious relationship between the structures and the surrounding environment.

A Personal Touch: The Experience of Living in a Usonian Home

Homeowners of these stunning Usonian structures often speak of the profound sense of peace they experience within their walls. The use of glass and open spaces allows natural light to flood in, revealing the beauty of the surrounding landscapes. For instance, the Bazett-Frank House, one of Wright's masterpieces in Hillsborough, California, creates an intimate dialogue between its interiors and the lush outdoor environment.

Living in such a home is not just about aesthetics; it’s about embracing a lifestyle. Homeowners like Laurence Frank treasure their Usonian residences, noting that they feel a connection to Wright’s philosophy every time they step inside. The homes cultivate a sense of community, inviting gatherings, and nurturing relationships, as families share meals at dining tables strategically placed to view the surrounding nature.

Wright’s Legacy Beyond the Bay Area

Wright's impact on architecture extends far beyond his time in the Bay Area. His designs are featured in numerous films and documentaries, from Hollywood classics to modern films, showcasing not just the structures themselves but also the philosophies underpinning them. His time in California was pivotal in that it revealed his ability to adapt his designs to various environments, blending style with functionality.

Additionally, Wright’s ambitions extended to proposals that were never realized, such as a whimsical wedding pavilion for the Claremont Resort & Club, demonstrating his constant quest for innovation and creativity.

Exploring the Usonian Aesthetic: Common Features of Wright's Designs

When examining Usonian homes, several hallmark features consistently appear: horizontal lines that mimic the land, flat or low-pitched roofs, large cantilevered overhangs, and an emphasis on natural materials such as brick, wood, and stone. These elements work harmoniously to create a striking visual balance that feels both modern and timeless.

In many Usonian homes, the interior presents an open floor plan that encourages fluidity and interaction among family members. Wright ingeniously incorporated built-in furniture, which optimizes space and promotes comfort, echoing the ethos of simple living.

Common Misconceptions Surrounding Usonian Homes

Despite their beauty and innovation, Usonian homes are often misunderstood. One common myth is that they are exclusively for the elite or wealthy. In reality, the Usonian concept was designed to make beautiful architecture accessible to middle-class families. Wright’s original intent was to provide affordable housing solutions through well-designed homes that did not compromise on quality.

The Future of Usonian Homes: Preservation and Growth

As society increasingly recognizes the importance of sustainable living, Usonian homes stand as relevant models for contemporary architecture. Their thoughtful designs encourage energy efficiency through natural resources and an intrinsic connection with nature. Preservation efforts by homeowners and local historians help keep Wright’s legacy alive, ensuring that future generations can appreciate the timeless quality of Usonian architecture.

Conclusion: Living Frank Lloyd Wright’s Philosophy

Living in a Frank Lloyd Wright Usonian home is more than occupying space; it offers an embrace of simplicity, connection, and beauty. These homes encourage residents to slow down, appreciate their surroundings, and enjoy the harmony present in their everyday lives. Whether you are in the Bay Area or beyond, understanding the significance of Wright’s Usonian homes invites us to rethink our own living spaces and their impacts on our lifestyles.

To discover more about the incredible homes designed by Wright and consider a step towards sustainable living, explore architecture in your area—promising a greater appreciation for your living space while also valuing the history behind it.

Add Row

Add Row  Add

Add

Write A Comment